Which Insurance Should You Buy for Parents Visiting the USA?

So, your parents are visiting the USA soon, and you’re scrambling to figure out the best visitor insurance plan.

Sound familiar? You’re not alone!

Choosing the right insurance can feel overwhelming, but don’t worry—I’ve got you covered.

Here’s the deal:

If you’re torn between US-based and Indian insurance plans, think about this: Would you trust a guide who knows every corner of the city you’re exploring, or someone who’s learning the ropes as they go?

That’s the difference.

⭐ Safe Travels Elite

Fixed Coverage plan. Covers up to a fixed maximum amount, insurer to pay the difference beyond.

Plan Type – Fixed Coverage.

Policy Max – $25K – $100K.

Doc Visit – $75/ Visit.

Telemedicine – Included.

Emergency – $350 per injury.

Walk-in – $55 per visit.

Prescription Drugs – $250 per illness.

Network – First Health PPO.

Acute Onset of Pre-Existing Conditions – Covered.

Theme Park Activities – Covered.

Cruise – Covered.

Duration – 5 to 365 Days.

Hospital Room – $1,400/Day

Underwriter – Crum & Forster SPC

Claims – Surego Administrative

⭐ Atlas America

Comprehensive plan.

After deductible, pays 100% up to policy maximum.

Plan Type – Comprehensive.

Policy Max – $50K – $130K.

Doc Visit – To policy max.

Telemedicine – Included.

Emergency – $150 Max.

Walk-in – $15 copay.

Prescription Drugs – To policy max.

Network – United Healthcare PPO.

Acute Onset of Pre-Existing Conditions – Covered*.

Theme Park Activities – Covered.

Cruise – Covered.

Duration – 5 to 364 Days.

Hospital Room – To policy max.

Underwriter – Lloyd’s

Claims – WorldTrips

⭐ Beacon America

After deductible, pays 100% up to policy max. Outside network: Pays 80% to $5K, then policy max.

Plan Type – Comprehensive.

Policy Max – $50K – $130K.

Doc Visit – To policy max.

Telemedicine – Included.

Emergency – To policy max.

Walk-in – $35 copay.

Prescription Drugs – To policy max.

Network – United Healthcare PPO.

Acute Onset of Pre-Existing Conditions – Covered*.

Theme Park Activities – Covered.

Cruise – Covered.

Duration – 5 to 364 Days.

Hospital Room – To policy max.

Underwriter – Lloyd’s

Claims – WorldTrips

Why US-Based Insurance is Worth It

US-based visitor insurance plans are built to handle the complexities of American healthcare.

They may cost a little more, but the peace of mind is priceless. Here’s why they’re a better choice:

- Higher Coverage: Plans often go up to $1 million—essential in the land of sky-high medical bills.

- Cashless Claims: No upfront payments or reimbursement headaches; just show your card at most hospitals.

- 24/7 Customer Support: Need help at midnight? Someone in your time zone has your back.

- Tailored for US Healthcare: These plans understand the system, so you don’t have to.

On the other hand, Indian insurance plans might seem cheaper at first glance. But here’s the catch:

- They often come with lower coverage limits, which might not cut it in a country where even a quick ER visit can cost thousands.

- You’ll likely need to pay out of pocket and then deal with a lengthy reimbursement process.

💡 Tip: Always check the look-back period, which is the timeframe insurers review for past medical issues. This ensures you’re clear on what’s covered.

Safe Travels Elite vs Atlas America

| Safe Travels Elite | |

| Best For | Travelers prioritizing health & electronics |

| Medical Coverage | High policy maximums, comprehensive |

| Emergency Services | Comprehensive, including repatriation |

| Coverage for Electronics | Yes, but limited |

| Flexibility | Less flexible in terms of policy customization |

| Customer Service | Top-notch, thorough |

| Pricing | Competitive, varies by travel details |

| Atlas America | |

| Best For | Adventurous travelers needing flexible coverage |

| Medical Coverage | Good coverage, with emphasis on outdoor activities |

| Emergency Services | Strong emergency medical evacuation coverage |

| Coverage for Electronics | Not typically emphasized |

| Flexibility | High flexibility in policy maximums and deductibles |

| Customer Service | Responsive, helpful |

| Pricing | Competitive, adjustable to budget and needs |

💡 Tip: If you want simplicity and security, go for a US-based plan. You’ll sleep better knowing your parents are fully protected.

Beacon America vs Atlas America

| Beacon America | |

| Best For | Straightforward, reliable coverage |

| Medical Coverage | Comprehensive, suited for high U.S. healthcare costs |

| Emergency Services | Solid support including repatriation |

| Coverage for Electronics | Less customization available |

| Flexibility | Straightforward and efficient |

| Customer Service | Top-notch, thorough |

| Pricing | Competitive, varies by details |

When comparing Beacon America and Atlas America insurance plans for Indian parents visiting the USA, think of them as two different types of safety nets.

Both offer comprehensive coverage, but with some key differences:

- Coverage limits: Beacon America offers policy maximums up to $1,100,000, while Atlas America goes up to $2,000,000.

- Pre-existing conditions: Atlas America covers acute onset of pre-existing conditions up to age 80, whereas Beacon America’s coverage for this is less clear.

- Urgent care: Beacon America has a $35 copay for urgent care, while Atlas America’s is lower at $15.

- Network: Both participate in the United Healthcare PPO network, providing wide access to healthcare providers across the USA.

Like choosing between a luxury car and a sports car, both plans offer high-quality protection, but Atlas America might edge out with its higher coverage limits and more extensive pre-existing condition coverage for older travelers.

However, Beacon America could be a more budget-friendly option for those seeking solid coverage without the highest limits.

| Atlas America | |

| Best For | Flexibility and adventurous travel |

| Medical Coverage | Strong, with emphasis on outdoor activities |

| Emergency Services | Robust evacuation coverage, great for remote locations |

| Coverage for Electronics | High flexibility in policy options |

| Flexibility | Detailed and responsive |

| Customer Service | Responsive, helpful |

| Pricing | Competitive with customizable options |

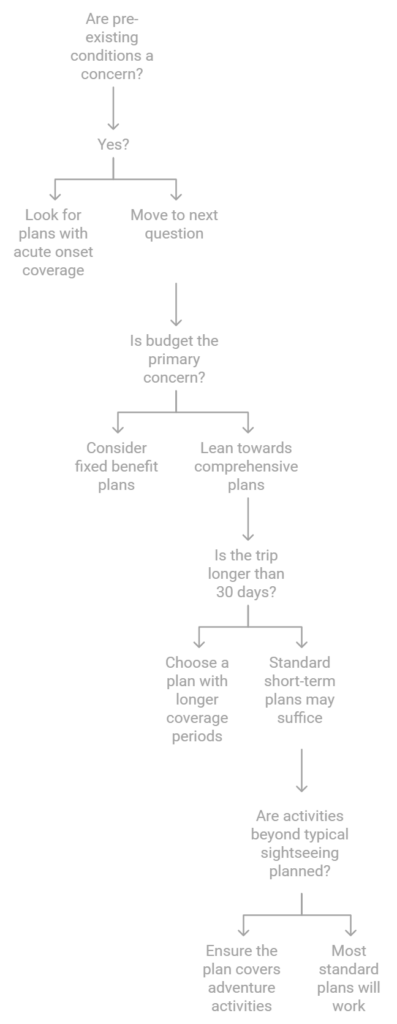

What About Pre-Existing Conditions?

Now, if your parents have pre-existing conditions, the stakes are higher.

Let’s be real—you can’t risk being unprepared.

Most visitor insurance plans only cover new illnesses or injuries, but you can get specialized coverage for pre-existing conditions.

Here’s what to look for:

- “Acute Onset” Coverage: This kicks in for unexpected flare-ups, like a sudden spike in blood pressure or an asthma attack.

- Lower Limits: Be aware that the coverage for pre-existing conditions is often capped.

- Comprehensive Plans: Options like INF Visitor Insurance offer broader coverage for pre-existing conditions but cost more.

Best Travel Insurance for US Visitors from India

Hidden Costs to Look Out For

When purchasing travel insurance for US visitors, watch out for potential hidden costs.

Here’s a quick overview of some common hidden costs to watch out for:

| Hidden Cost | Description |

|---|---|

| Deductibles | The amount you pay before insurance kicks in, often ranging from $0 to $5,000 |

| Co-insurance | Your share of costs after meeting the deductible, typically 20% for in-network care |

| Out-of-network fees | Higher costs for using providers outside the insurance network |

| Exclusions | Certain conditions or activities not covered, like extreme sports |

| Pre-existing condition limitations | Limited or no coverage for existing health issues |

While Indian insurance plans may seem cheaper initially, they often have lower coverage limits and may require you to pay upfront and seek reimbursement later. This can lead to significant out-of-pocket expenses, especially given the high cost of healthcare in the US.

US-based plans, though potentially more expensive upfront, typically offer higher coverage limits (up to $1 million or more) and better access to healthcare providers, potentially saving you money in the long run.